Credit life insurance emerges as a valuable shield for borrowers in financial security. Whether considering a mortgage, car loan, or personal credit, understanding the top 10 advantages of credit life insurance is essential.

This article explores this insurance's significant benefits, ensuring you make informed decisions about safeguarding your loans and your loved ones' futures.

What is Credit Life Insurance?

Credit life insurance is a policy that pays off a borrower's loans or mortgages in the event of their death, offering financial security to loved ones and simplifying the repayment process.

The purpose of credit life insurance includes:

- Debt Repayment: To ensure that outstanding loans and mortgages are paid off in full upon the borrower's death.

- Financial Security: To provide financial security to the borrower's loved ones by preventing them from inheriting debt.

- Peace of Mind: To offer peace of mind to borrowers, knowing that their debts won't burden their families in case of unexpected events.

- No Medical Exam: To provide coverage without needing a medical examination, making it accessible to a broader range of individuals.

- Quick Settlement: To facilitate the swift settlement of outstanding debts, reducing stress for surviving family members.

- Simplified Application: To streamline the application process, often integrated with loan approval, making it more convenient.

- Affordability: To offer budget-friendly premiums, ensuring borrowers can protect their loans without significant additional costs.

How Does Credit Life Insurance Compare to Other Forms of Coverage?

Credit life insurance is unique in its focus on loan repayment, especially in the event of the borrower's death, and it differs from other forms of insurance in several key ways:

- Life Insurance: Credit life insurance ensures loan repayment on the borrower's death, while traditional life insurance offers broader financial protection.

- Mortgage Insurance: Unlike credit life insurance, which settles the borrower's debt, mortgage insurance safeguards the lender from borrower default.

- Disability Insurance: Credit life insurance addresses loan repayment, not income replacement, in case of disability, unlike disability insurance.

- Health Insurance: Credit life insurance isn't linked to healthcare costs and may be accessible without medical exams, unlike health insurance, which covers medical expenses.

- Auto Insurance: Auto insurance covers vehicle-related issues, while credit life insurance deals with loan obligations, not vehicle protection.

- Property Insurance: Property insurance safeguards physical assets, while credit life insurance focuses on financial obligations.

Advantages of Credit Life Insurance

Credit Life Insurance is a specialized form of protection that offers distinct advantages to borrowers. Safeguarding loans and providing financial security ensures peace of mind during loan repayment. Here are ten key benefits:

Financial Security for Loved Ones:

- Credit life insurance ensures that their outstanding loans are paid off in the event of the borrower's death, providing financial security for their loved ones.

- This advantage relieves families from the burden of debt during a difficult time.

Real-life Scenario:

Credit life insurance pays off outstanding loans if the borrower passes away, offering financial security. For instance, it ensures the family can keep their home after the primary breadwinner's death.

Debt Protection:

- It safeguards borrowers and their families against the impact of unexpected events, such as illness or death, by settling outstanding debts.

- This prevents assets or the borrower's estate from being used to cover the debt.

Real-life Scenario:

It settles debts in emergencies like high medical costs and protects family assets. For instance, it prevents the need to sell assets or dip into savings during a health crisis.

No Medical Exam Required:

- Credit life insurance typically doesn't mandate a medical examination, making it more accessible to individuals, even those with pre-existing health conditions.

- The absence of a medical exam simplifies and expedites the application process.

Real-life Scenario:

Credit life insurance is accessible without medical exams. This helps individuals with health issues get coverage, avoiding higher premiums.

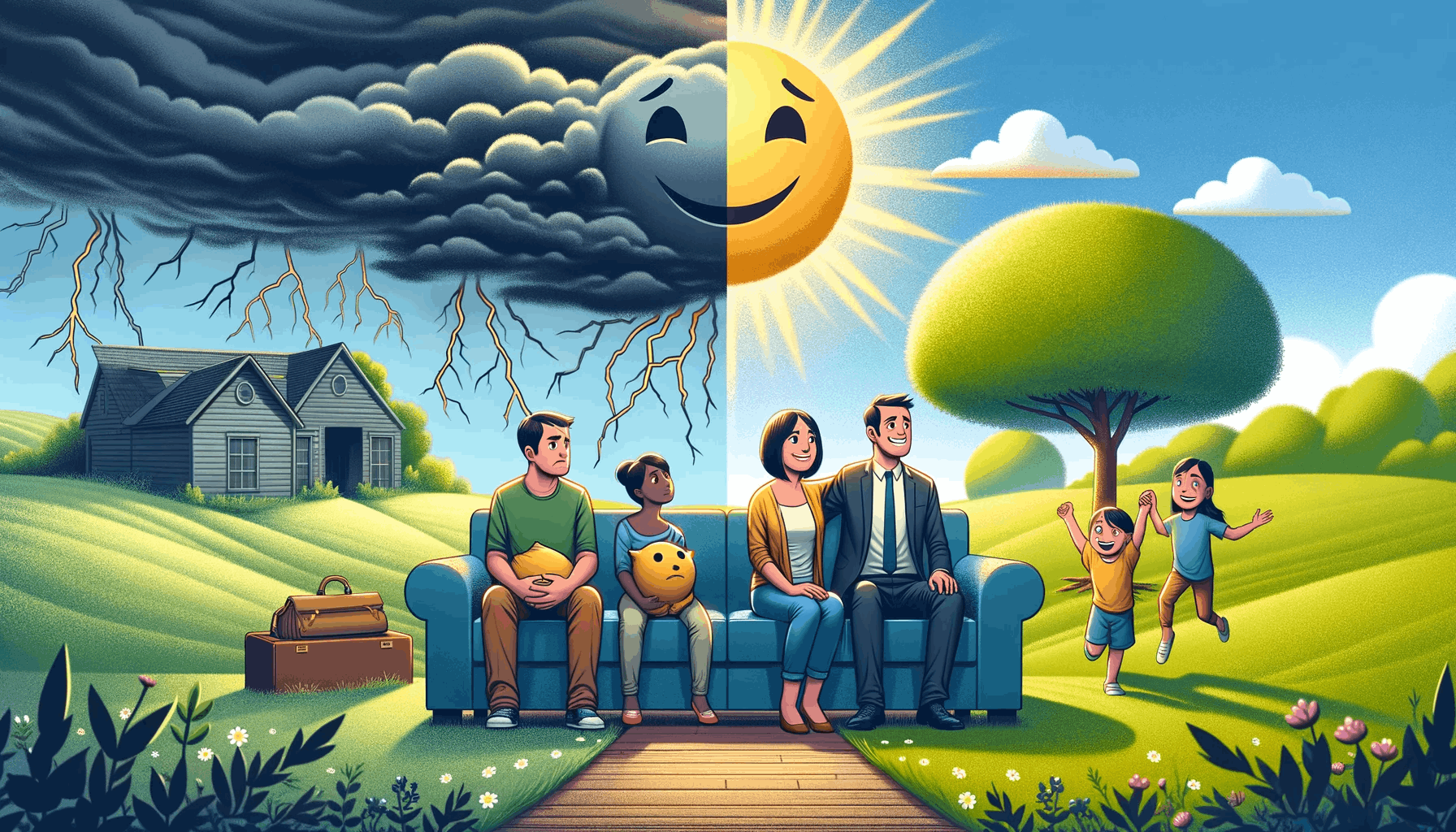

Peace of Mind During Loan Repayment:

- Borrowers can experience peace of mind, knowing that their loans will be paid off if unforeseen circumstances prevent them from doing so.

- This assurance eliminates worries about leaving behind debt for loved ones.

Real-life Scenario:

Borrowers gain peace of mind knowing loans will be repaid, even if unexpected events impact their income.

Coverage Regardless of Health Conditions:

- Credit life insurance offers coverage irrespective of the borrower's health condition, providing an option for those struggling to obtain traditional life insurance.

- This inclusivity is especially valuable for individuals with health issues.

Real-life Scenario:

It's inclusive, providing coverage irrespective of health conditions and options for those struggling with traditional life insurance.

Simplified Application Process:

- The application process for credit life insurance is straightforward and often integrated into the loan approval process.

- This simplification reduces the paperwork and time required for application.

Real-life Scenario:

Streamlined applications during significant purchases like homes reduce paperwork and hasten approvals.

Affordability:

- Credit life insurance generally comes with budget-friendly premiums, making it accessible to many borrowers.

- The cost of coverage is typically reasonable compared to the potential financial consequences of not having it.

Real-life Scenario:

Credit life insurance offers budget-friendly premiums, protecting significant loans without straining finances.

Flexibility in Coverage Amount:

- Borrowers can often choose the coverage amount that matches their loan balance.

- The flexibility to adjust coverage as loans are paid down or when taking out new loans is valuable.

Real-life Scenario:

Borrowers can adjust coverage to match their loan balance, avoiding unnecessary costs.

Easy Integration with Loan Payments:

- The borrower's monthly loan payments typically include a premium for credit life insurance.

- This integration simplifies budgeting and ensures that coverage remains active.

Real-life Scenario:

Premiums included in monthly loan payments simplify financial management.

Quick Settlement of Outstanding Debts:

- Credit life insurance facilitates the prompt settlement of outstanding debts in case of the borrower's death.

- Swift resolution reduces stress and financial uncertainty for surviving family members.

Real-life Scenario:

In case of the borrower's death, it swiftly settles debts, reducing stress and legal complications for surviving family members.

Who Should Consider Credit Life Insurance?

Credit Life Insurance isn't one-size-fits-all. Here's a guide to help you determine if it's the right choice for you or someone you know:

- Borrowers with Significant Loans: Individuals with large loans can protect their families from debt.

- Families with Single Income Providers: For families relying on one income, it ensures loan repayment if the provider passes away.

- Individuals with Health Concerns: Those with health issues appreciate its accessibility without medical exams.

- First-Time Homebuyers: New homeowners use it to safeguard against unforeseen events when securing a mortgage.

- People Seeking Simplified Coverage: Those who prefer straightforward insurance integrated with loan payments benefit from its simplicity.

- Borrowers with Flexible Premiums: Individuals can tailor coverage amounts and premiums to their needs.

- Anyone Looking for Swift Debt Resolution: Credit life insurance ensures quick debt settlement, reducing the financial burden on loved ones.

How to Obtain Credit Life Insurance

Securing credit life insurance is a straightforward process. Here's a step-by-step guide to help you obtain the coverage you need:

- Eligibility Check: Ensure you qualify as a borrower or co-borrower on a loan.

- Loan Application: Apply for the loan you want to cover with credit life insurance.

- Choose an Insurer: Select an insurer, often offered by the lending institution or others.

- Coverage Amount: Determine the coverage amount matching your loan balance.

- Complete Application: Fill out the insurance application with personal and loan details.

- Underwriting and Approval: Your application is reviewed and approved with simplified underwriting.

- Premium Payment: For convenience, set up premium payments, often included in your monthly loan payments.

The Bottomline

In conclusion, credit life insurance offers essential advantages, including peace of mind and financial security.

Its unique benefits, from quick debt resolution to accessibility, make it a valuable choice for borrowers looking to protect their loans and loved ones in times of need.