Investing in stocks is one of the tried and tested ways of putting your money to good use. You get to earn money passively while ensuring a more secure future.

While it takes a lot of time to see the results, investing in stocks has never failed throughout the decades.

To learn more about investing in stocks, check out the guide below.

What is Investing?

Investing is a method where you commit a certain amount of money into a campaign with the expectation that you will earn a portion or percentage of the money you invested.

Investing in stocks is one of the best ways to earn a passive income. It puts your money to work so you can passively earn over time.

Investments also come with benefits and risks, so you must understand how the entire market works. You can start investing in stocks today with amounts as low as $100.

Why You Should Start Investing

While you may think that buying and investing in stocks is volatile, the advantages and benefits outweigh the risks involved.

Investing in stocks is always a good idea, even when the market is on a downward trend.

It is all about proper timing; being able to do this accurately takes time and experience. This is the reason why you should start investing today.

Key Benefits of Investing in Stocks

There are a lot of benefits to investing in stocks.

Not only do you secure a future where you don't have to worry about finances, you are also getting a lot of advantages in life.

Here are some of the key benefits of investing in stocks.

Earn Higher Returns

One of the many reasons why people invest in stocks is the potential. Stocks have a very high return compared to deposits and treasury bonds.

You can get up to 5% to 6% yearly when you invest in stocks, especially with the government's help.

The numbers might be meager, but when you look at your investments years later, you might be surprised at the returns.

Protection from Inflation

Stock market returns usually outpace the rate of inflation.

For example, if the current inflation rate is at 4%, you still have a few more per cent to earn and at least weather through the rough inflation rate.

This is the reason why a lot of people are looking towards investments during high inflation rates.

Earn a Passive Income

When you invest in stocks, you do not have to do anything besides monitoring your finances.

Everything is done for you, so you need to wait for your money to be credited to your account and do what you want with it.

You can even put it back into your investment fund to earn more.

Start Small

The thing about investing in stocks is that there are no ceiling and floor limits on how much you can invest.

You can always start small with your investments, and as soon as you start to earn, you can add those to your fund.

Many investors often purchase stocks that are less than $100.

How to Invest in Stocks

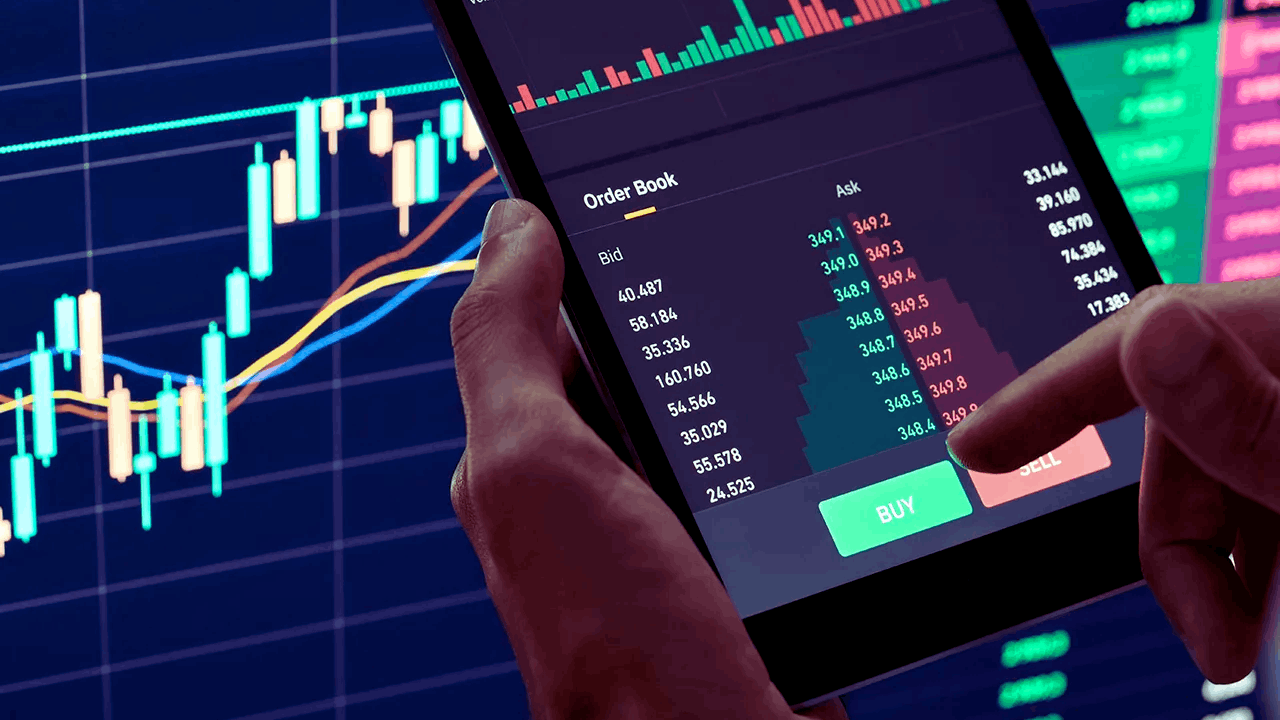

To start investing in stocks, the easiest way to do this is to create an online investment account or a brokerage account.

There are a lot of legitimate apps that offer these services online where you can even gain access to financial advisors.

Decide How to Invest

Once you have an account, choose the option that suits you the best and how you are as an investor.

Most of the time, you will undergo an assessment of who you are as an investor, and you will be profiled.

Once done, you can choose to either stock funds on your own, have an advisor manage it for you, or always invest in your employer's 401K plan.

Setting a Budget

Now that you have chosen how you want to invest, you should also enter how much you want to invest.

The best part about investing in stocks is that you can start with an amount as small as $100 but also go for $1,000 or more.

Focus on Long Term Investments

Investing in stocks means that you are in it for the long haul.

The stock market offers good investment and returns if you want to invest long-term.

You can invest your funds, leave them for a few years with proper monitoring, and see the results after.

Tips for Investing in Stocks

Investing in stocks might be accessible on paper, but it can be tough, especially if you are new to this industry.

Here are some tips for investing in stocks.

Buying the Right Investment

It is always easier said than done when purchasing a suitable investment.

You can see the success of the stocks by looking at the past, but it is much harder for you to predict the performance of a stock in the future.

This is why you need to analyse and monitor the market to make good decisions on buying the right investments.

Always Be Prepared

When it comes to investments, it is not always daisies and sunshine.

There will always come a time when you'll experience a loss on your investments. This is because the market can fluctuate at any time.

There are a lot of factors to this, but overall, you need to be prepared when this happens. You need to handle losses adequately and endure them.

Diversify as Much as Possible

And because the market can fluctuate at any time, it is always best to diversify your stocks as much as possible.

This means you need to invest in many different kinds of stocks instead of just one.

Diversifying means you can have some stocks that might be on a downward trend while others are in the upward direction. This can help you handle your investments much better.

Use a Stock Market Simulator

A stock market simulator uses virtual money where you can play around and understand how to invest in stocks.

This will help you gain valuable information on how the stock market works and how you can react to certain situations.

It will also help you set proper and realistic expectations for handling your investments.

Conclusion

Investing in stocks is always a rewarding experience, especially if you learn the basics and how to take advantage of the market. Beginners should start today and find an investing plan so they can be in it for the long run.